Dear

Perspective Fifth Third Bank Customer,

Before

paying any money to Fifth Third or signing any documents, I urge you to read

the following account of my mortgage refinancing experience. I hope it will be

sufficient to make you walk away quickly, before Fifth Third extracts any

down-payments.

My plight

began on 5/29/2012. As many of my countrymen, I am underwater in my real estate

and am unable to refinance by traditional means. Fifth Third bank was listed in

Freddie Mac’s syllabus of lenders who finance under HARP and approve

loan-to-value ratios of up to 125%. Since the market rates for mortgages were,

and still are, significantly less than my rate of 2007, I had but a single word

to utter: SOLD. I called several local branches including:

*

Kelly

Price - 837 W North Ave

*

Martha

Ramirez - 1209 N Milwaukee Ave

*

Michael

Klein - 29 W Division

*

Ken

Dickerson - 900 W Armitage

Of these,

surprisingly, only Ken Dickerson chose to call me back which should have served

as red flag enough to walk away. But in my mistaken wisdom of convention, I

figured that a person with a credit score approaching 800, a solid, long-term

job and a property that fits pretty well within the government’s idea of relief

that I could refinance without the point and pressure of an independent

mortgage broker. Those people, I have always thought, made their pennies on

pushing regular people over the cliffs of asymmetric information. Perhaps. But at least our interests overlap at the time of

closing. I do not know how people at Fifth Third get compensated but however

they don’t or do, they show absolutely no interest in closing their customers.

By 5/30, Ken

Dickerson had locked my loan at 3.99%. Not bad considering I resisted all

tactics to upsell and all promotions and points and still got a pretty decent

deal on closing costs. Making timely payments SHOULD have its privileges. Ken

advised me that the process could take 2 months and set a closing date for

July. He also advised me he was very busy and calling to follow-up would be a

waste. He’ll call me he said. Red flag 2.

The next

time I heard anything meaningful from Ken was 7/12. I had to follow-up since I

hadn’t heard from an appraiser and my lock expired on 7/30. Could they have

appraised my unit from outside? No! Better! They appraised using Freddie Mac’s

Automated Valuation Model. This is truly

genius. Fifth Third lists on their HUDs: charges of $350 for the appraiser and

$140 for the Appraisal Management. 2 lovely scams in one! First of all, the

appraisal isn’t 500 as with other banks - no, theirs is only 350, the

management company fee is just a line item you shouldn’t notice. And then, why

not just use the AVM and pocket the entire sum outright? This may be a rounding

error on the corporate luncheon bills but it’s a meaningful sum to the average person

who needs HARP. This, by the way, was the last I’d hear from Ken Dickerson, Nationwide

Mortgage Registry # - 716410.

By 7/14, I

was contacted by Lisa, Ken’s processor, asking for some data. This alarmed me

not at all since the originator seldom bothers with the tedium of details. But

as my phone calls in to Ken remained unanswered - for 10 days - I grew

genuinely worried. After all, my lock expired 5 days from then. I looked up

another way to contact him.

In our inter-netted

world, finding anything on anyone is no hard task. There is no information

security and it seems that we don’t want it. There is just obscurity but those

of us whose name is not John Smith, don’t even have the cloak of that. Turns

out, Ken Dickerson had another job! At Wells Fargo, as stated on Linked In and

the Wells Fargo site itself. Now, I was not angry with Ken at first. Many

banks, in their security obsession, immediately cut off ALL employee access to

their systems and I have even heard before of employees being escorted out

forever by security. This was not such a case. Everyone knew for a long time

that Ken was leaving and could not be bothered to transition (or even inform)

any of his portfolio of customers. His cell phone is still the same. He could

have called me if he cared. He doesn’t - and probably won’t care about you

either.

From this

point, I will organize my experience like a not-so-dear diary.

07/25/2012

Enter Walter,

Area Sales Manager. Walter was Ken’s manager. The same one who decided that

Ken’s customers need his silence? I don’t know. But he would be handling me

from this point forward. Excellent I thought. Until, a short time later, I

realized that the guy responsible for 50 guys like Ken was probably their

enabler-in-chief.

Ken and

Walter, despite my telling both of them, had chosen to either not to hear, or

forget the fact that I had a second mortgage through my old lender: Provident

Funding in California. In HARP refinances, the borrower is unable to borrow

more than his current debt on his primary mortgage. This is RELIEF, remember?

Not cash-out. Naturally, I had no idea of the process and hoped that people

who, you know, WORK in the industry could guide me. Walter instructed me about

the "subordination process" to which a second lender must agree before the

primary could be refinanced. This, Provident does on a case-by-case basis. Of

course they do. Again, I am a pretty decent credit risk and have always made my

payments to Provident and everyone else on time. So, once they got their $150

fee to prepare the subordination things were golden. Or were they?

Provident

states clearly that they ONLY ship the package at the borrower’s expense via

FedEx. I asked Walter if I needed to obtain this label. A firm "no" was his

response. This he reaffirmed while standing in my house collecting the

cashier’s check so we could present Provident a united front and just one

package. One never knows what confusion 2 separate packages might cause. "We’ll

take care of it" said Walter.

And, by

taking care of it, Walter meant he shipped his corporate UPS label to Provident.

Remembering the instructions I was ready for a problem. By now, it was 8/9/2012

and my lock had been extended. "This will be free of penalties" Walter

proclaimed. He must have forgotten that I already paid my August mortgage at

the higher interest rate, by now rates were down to 3.5% while I was re-locked at

3.99%. This gave the bank an already healthy spread and Walter tells me that I

won’t get penalized for his and his staff’s ineptitude. Thanks, I guess. And I

went on my vacation.

From upstate

Washington, where a cellular signal is far from assured, I monitored what I

knew would be a problem. Neither Walter/Fifth Third nor Jodie/

Loss Mitigation Specialist at Provident would budge. Had I the ability

to go to FedEx and arrange a pickup I would have. And, while Walter claimed the

entire time that he would PERSONALLY arrange the prohibited shipping vendor he

never did. FedEx was blocked by Fifth Third’s corporate firewall he said. He’d

need to go to a physical location. The absurdity of this should not easily be

bypassed. Does his corporate cell phone even work in a FedEx facility? Does his

car? What about the credit card? I’ve heard many tales in my time but claiming

that a company, even a bank, blocking vendors they don’t use means that Walter

takes me for a buffoon of a very high order. Maybe the fact that I was still

awaiting his assistance meant I was.

The days

grew into weeks as Jodie pleaded with Walter to provide a label. She and

Provident are not completely without blame for ridiculously strange rules but

they were as clear as crystal in the vendors they allow and, most importantly:

THEY DON’T NEED ANYTHING FROM US. For all Jodie cared, I can stay with

provident for life paying double market rates. By 08/27/2012, Jodie finally

took pity on me and walked the subordination agreement over to a UPS box. I

asked Walter for an update every day. He ignored me expertly. I didn’t even

know if they approved the sub. By 8/30/2012 I knew they had. Victory! I hoped.

But no! I needed to provide the entire financial picture again! I may have been

fired or rung up debt in the meanwhile right? Fine.

They also pulled my credit. Each pull, materially affects my credit score and

potentially increases my cost of borrowing. There is a lot attached to this

little number. We all know not to go applying for credit with impunity. On

08/30/2012, they also ordered another payoff statement. It never occurred to

anyone that we would NEVER EVER close in August with a day remaining. Each

statement costs me $20 and, since obviously I would have made a payment since

the last one, there would be another on my horizon. Spending other people’s

money is never a problem for big banks.

09/13/2012

I remain in

the financial purgatory of Fifth Third Bank except whereas Dante had Virgil to

guide him, I have Walter. I will argue that my very presence in this hell is

Walter’s doing in a large degree but that’s irrelevant. I emailed Walter for an

update. He emailed back to say he needed "a few." That was 3:18 PM and it’s now

6:34. "Few" hours perhaps.

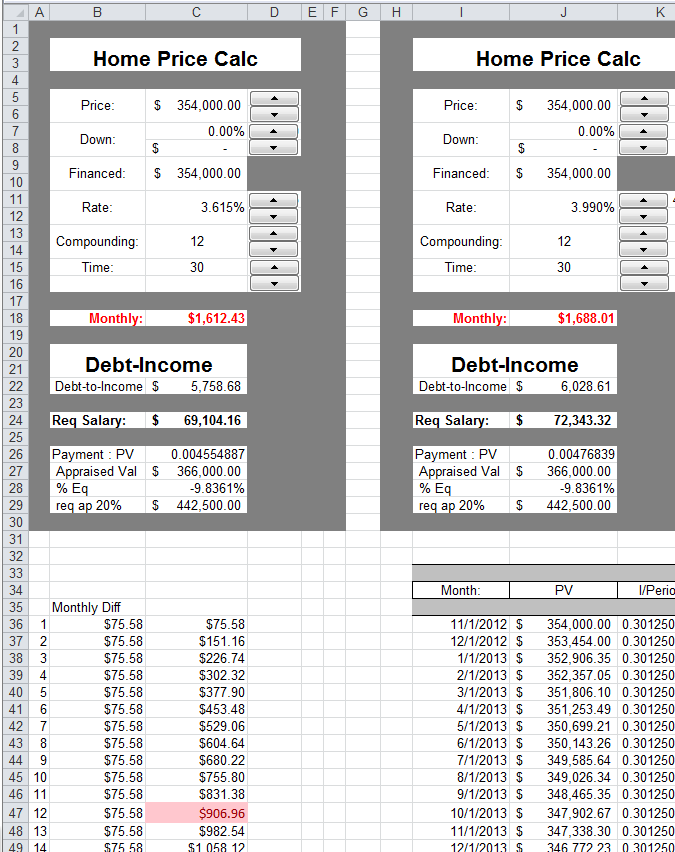

As we

approach what I hope is the parting chapters of this letter I think it is

important to illustrate how Fifth Third in particular but probably all banks in

general cheat you, the prospective mortgage payer. They rely on your ignorance

and their fast-talking salespeople to push you into deals you should never

sign. I have a Finance education, am a computer nerd by profession and live a

life of partially repressed obsessive compulsion. Meaning I know every penny of

my finances, my point of currency in the amortization schedule, and have

pre-written Excel functions to calculate everything any lender could possibly

tell me. If I am taken for a ride this badly, how can the average borrower

expect to not be duped?

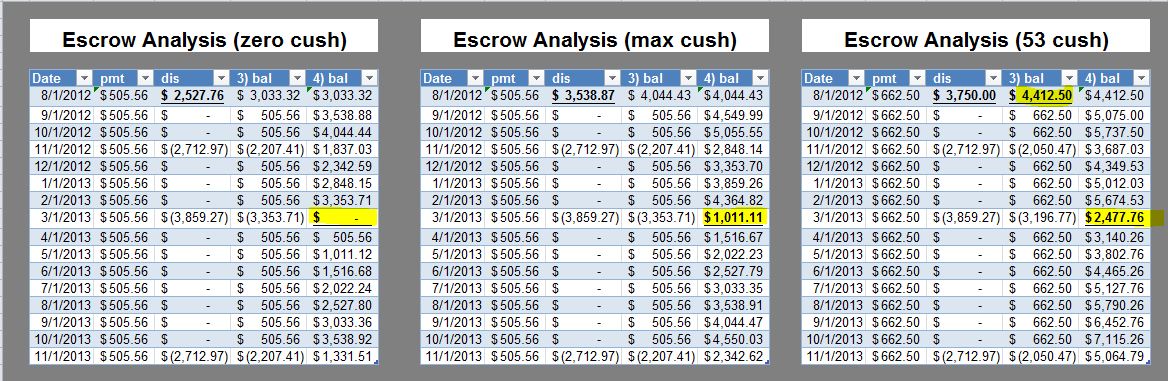

Escrow:

At this

time, it might be useful to see how Fifth Third Bank, either by obfuscation or

plain thievery, attempts to cheat honest people into giving them loans. What

else do you suppose an escrow account is? It’s an interest-free loan you are

making to the bank. The below three scenarios illustrate my escrow account

during 12 months of deposits and semi-annual tax payments with Provident. The

first shows a cushion of 0 - which almost no one does because they don’t have

to. The second shows the maximum allowed cushion of 2 months (2/12=1/6) of the

annual tax payment and the last shows Fifth Third’s proposed accounting. They

would be required to disburse this amount to the borrower but, I don’t know

about you, I’d love to have 2500 sitting in my account, earning interest for

me, not for them.

I don’t

completely discount escrows. Remember that you don’t actually own your places.

The banks do and let you live there as long as you pay your mortgage AND...your

taxes. So if you choose not to pay them your municipality can seize your

property. If they didn’t collect taxes you could, potentially, in that scummy

way of yours, cost the bank big money and this adjusts your risk profile. If

you have the option to forgo escrow, it will almost always cost you

points/interest.

Taxes:

Taxes are

receding in Cook County. We know this. Not fast enough if you ask most people

but at least they overcame inertia and are moving in the right direction. Fifth

Third Bank chooses to ignore obvious and public information on approved 2012

rates, homeowner exemptions, and surplus funds.

My rates and

estimates should have been done properly. No borrower should have to battle

this to get his escrow ordered properly. I do not believe that average people

should be in the business of loaning money to banks interest-free.

Out of

Pocket:

My total

out-of pocket currently is $395 to Fifth Third, 150 to Provident and the $651.72

x 2 extra months that I pay in additional interest compared to my Provident

Rate - total: 1303.44. My total out-of-pocket is 1848.44. Walter claims that my

closing costs of $2100 would be covered. If so, great.

If I walk

away right now, I could probably lock a loan for 3.615%. Depending on how long

it took to close, I could make up the difference in about 2 years. If I arrive

to closing and things are out-of-order, I swear I’m walking out.

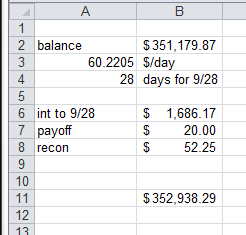

09/11/2012 Payoffs:

Walter sends

me HUDs with a loan amount of 3k more than the original. Is this how he

"pretends" to absolve me of my closing costs? Upon protest he explains that he

was operating on a decrepit payoff statement. WHYYYY?

One may ask. But it turns out he just wants to order another one for 20$/pop. Walter

does this every day. I hope. (He claims he’s busy - too busy to call me

certainly.) So why couldn’t he just do what I did below? It took me all of 3

minutes based on the other payoff statement. I would have granted him 10

because he probably didn’t have my amortization schedule in front of him but

still. Was he hoping I’d not notice and just let him pad the loan with all my

promised closing costs and then some? Nothing would surprise me at this point.

09/13/2012 -

trying to get an update:

Walter is

not an email person. He answers calls pretty well but not today.

09/14/2012

Walter

decides to answer email but not the call. This is a rarity. I hear from Lisa

George (processor) who says the underwriter insists on seeing "documentation"

of a 7k deposit into one of my savings accounts. The source was my Citibank

savings account after they dropped interest rates from 1% to .1% overnight. Why

would I keep any money there?

Lisa emails

me to tell me that we’re set to close and asks for my availability. ASAP is the

answer. But I still await an accurate reflection of my costs and payment.

Walter remains silent.

09/15/2012

I downloaded

the new documents - thank you.

There remain

a couple of issues which, although known for some time, Walter has been either

unable or unwilling to resolve. I am hoping you can provide an explanation.

From this

prior email, only issue #2 is no longer fully relevant - however, Walter and I

agreed to a credit ~2100 to account for the inappropriate charges for

appraisals since one was never done.

My main

question is on the loan amount. Every form I download shows a higher number.

Mainly, I would like to know where the extra money goes. Based on Provident’s daily interest rate, the payoff, if we close on

9/28, should be: (Btw, I’d love to close earlier - ASAP)

|

balance |

$351,179.87 |

|

60.2205 |

|

|

28 |

|

|

int

to 9/28 |

$ 1,686.17 |

|

Payoff stmt |

$ 20.00 |

|

recon |

$ 52.25 |

|

$352,938.29 |

Where is the

other 6k reflected in the original loan amount going? And why does it keep

growing to begin with? Is there human interaction responsible for it or is it

computerized? In any case, any loan amount over 354k is in clear violation of

the subordination contract with Provident.

All I

require is an explanation. Could you either provide one or chase down someone

at your office who can?

Thank you,

Me

Walter

Sat

9/15/2012 10:13 AM

Actually,

I

believe there were 5 questions you had. I thought we discussed each of these,

and I know you had a question on the payoff and loan amount as well. I

instructed Lisa yesterday morning to change your loan amount back to $354,000.

Your

credit is showing in our system as $1793.93. As I stated earlier, I can not print out a Good faith Estimate - they do not allow

me to

There

will be no appraisal fee since an appraisal was not done. On the closing

statement, you will not see an appraisal fee or an appraisal management fee.

You WILL see an appraisal fee waiver - I believe that is $75.00. Lisa, if I’m

wrong, please correct me. You will also see your $395

as a credit on the HUD-1 settlement statement at the closing.

Finally,

the escrow account will show the amount of money needed to pay your taxes plus

two months- the amount we are required to hold "in reserve".

I

will call you to discuss as well.

Sat 9/15/2012 10:57 AM

Thank you for

replying.

None of this is a problem and i certainly understand tech limitations.

But please accept this inability to accurately assess my position as my fair

warning that I will not sign any document where inaccuracies persist.

Thanks.

Sat

9/15/2012 11:03 AM

I

agree - and it will make a lot more sense once I can show you the closing

statement - which, unfortunately, won’t be until we set a closing.

What

I propose is us setting a closing ASAP but 4-5 days out os

that closing ahs timer to prepare a package early.

That way, if there are corrections, we can make them and still ensure a smooth

closing. Agreed?

Have

a great weekend!

9/21/2012

We

seem to have a proper closing. Walter shows up on time and actually starts

hunting for the closing agent from First American Title and Trust (630.799.7389).

He arrives somewhat on time - we certainly understand being new to city traffic

and coming from O’Hare.

There

is an extra $304.79 for a supposed "principle reduction" that was never agreed

to or in any documents. Of course, had they actually sent over preliminary

documents we would have caught it pre-facto but Walter and his team at Fifth

Third Mortgage were just simply not capable of this heroic effort.

The

other copies of the forms do not contain this amount and I’m not going to botch

the closing for 300 bucks that they’ll hopefully refund the next day. I know I

said differently but have just no more fight left in me.

100

signatures later, we are done. Included in the forms is an auto-debit form. We

attach a cancelled check because I still have some from 2005. I only write

checks for people as gifts and may even stop doing that with the advent of PopMoney. So if you need a cancelled check from me, let me

know! I wish I could cancel all of them.

Would

it be anti-climactic if I told you that neither the form nor the check made it

to where they were supposed to go? Would it also surprise you that they didn’t

actually send anything in the day I signed it? I hope not.

9/26/2012

(rescission period ended on 9/25)

From: Me

Sent: Wednesday, September 26, 2012 9:39 AM

To: Walter

Subject: Refi

Walter,

Did everything conclude correctly

with the closing? My check has not been cashed and Provident shows no changes

in the loan amount.

Do I need to call the title company?

From: Walter

Sent: Wednesday, September 26, 2012 9:53 AM

To: Me

Subject: RE: Refi

They

start counting the day after. Funny thing - Saturday actually counts as

a business day!

From: Me

Sent: Wednesday, September 26, 2012 9:55 AM

To:Walter

Subject: RE: Refi

One

learns new things every day!

I’m

still waiting to see what the story will be with the "principle reduction"

(that extra ~$300) since only one copy of the documents had it. In you

experience, do title companies routinely try to sneak in things like this and

hope no one notices? I don’t really care about the reduction - just so long as

it’s not a little bonus to the title agents.

Anyway, thanks for all your help.

From: Walter

Sent: Wednesday, September 26, 2012 10:00 AM

To: Me

Subject: RE: Refi

No,

they are not hiding it, they will apply it.

9/26/2012

The

old mortgage is indeed paid off. It just takes Provident a day to post it.

9/30/2012

I

receive the refund for the $304.79. Looks like genuine stupidity triumphed over

disingenuous dishonesty.

10/4/2012

I

receive a payment coupon book and assume it’s just routine.

I signed up for auto-debit remember? Why would I

expect the payment coupon department to know what the auto-debit department knows

right? This is a bank that took 4 months to close and couldn’t even tell I had

a second mortgage. PIN searches are not part of the mortgage brokers’ duties I

guess. In Walter’s defense, this FAIL was on Ken Dickerson.

I

give up after 15 minutes of waiting on hold.

10/16/2012

I

put in my earpiece and call the help line. I also want to set up online access

but no way is this something that should be clear from the web site right?

People might sign-up on their own. Perhaps this is why the hold time is what it

was? After 10 or so minutes, I get through (time flies when you’re trying to

read code while on hold and trying to ignore the idiotic music). Also, Fifth

Third Bank has a really interesting tactic in that the music fades into empty

silence every minute or so which makes the caller wonder if the call is still

connected. Perhaps this is how they auto-disconnect people and prevent them

from calling back immediately.

Anyway,

the gentleman lets me in on the secret. My login is my incredibly secure (known

to every phone rep EVER) Social Security Number and temporary PIN is XXXX.

Well, actually, it’s 3795. I already changed it so don’t get ideas. But if this

novel’s worth of complaining can’t convince you to finance somewhere else, try that

PIN and see if it starts this way for everyone.

After

obtaining the super-secret key to online access, I am forwarded to the Auto BillPayer department where a woman answers. "We didn’t

receive anything" she proudly proclaims and because the 80 signatures they had

from closing are insufficient, I will need to fill out ANOTHER Auto Debit form with

a signature and FAX it in!!! Yes, in 2012 we are using technology from 1973 to

make sure that I am myself and have not yet jumped out of my skin from this

experience. I ask her if this call is being recorded. She says yes. "Good" I

say and begin a narrative of this complaint. She hangs up. Or maybe she faded

with the music. Or maybe the disconnect is automatic

when the customer actually begins talking.

I

call First American Title 630.799.7389 and ask if they still have my form. To

my delight a woman answers on the second ring without sending me into a maze of

"we appreciate your call" (so much that we want you to hang up). They have

nothing. I inform the nice young lady that they are also party to Fifth Third’s

stupidity and I will, if I find out that it was they and not Fifth Third that

put my document anywhere other than where it belonged, reserve appropriate

domain names and tag them much and often. She understands.

I

call Walter. It’s been an hour and a half. No calls.

Walter

called at 4:40 PM. No answers. No knowledge. He’s checking. Called back 2 min

later, offered to give me the third-party service Fifth Third uses. I asked if

he really thought I would have bothered him unless I already called and struck

out. He said he’ll call back tomorrow.

*